CNBC IQ 100 Index: Who’s in, who’s out?

CNBC IQ 100 Index: Who’s in, who’s out?

CNBC’s Dominic Chu takes a look at the companies featured in the CNBC IQ 100 Index.

Nike among today’s IQ100 leaders

Nike among today’s IQ100 leaders

The CNBC IQ100 index beating the broader market over one year up 26%. Today’s leaders include UnitedHealth, Johnson & Johnson, Nike and Edwards Lifesciences.

Monsanto up nearly 2%

Monsanto up nearly 2% from CNBC.

Monsanto up nearly 2%

The CNBC IQ100 index beating the broader market over one year up 26%. Today’s leaders include HP Inc, Nabors Industries, Monsanto, Western Digital and Sony.

IQ100 index beating market by 25%

IQ100 index beating market by 25%

Motorola Solutions leading the IQ100

Motorola Solutions leading the IQ100

DowDuPont takes top spot in IQ 100 Index after gaining 5% since megamerger

from CNBC.

DowDuPont takes top spot in IQ 100 Index after gaining 5% since megamerger

The CNBC IQ 100 Index continued to outperform for the first three quarters of 2017, rising 15 percent and outpacing the S&P 500′s 13 percent gain.

As part of its rules-based methodology, the index has been reweighted for the fourth quarter. MCAM International, the firm whose proprietary algorithms power the CNBC IQ 100, executed the reweighting for CNBC.

Last quarter’s leaders, 3M and Oracle, have been dethroned by the product of inter-index M&A: DowDuPont, a combination of two previously separate IQ 100 members, takes the top spot.

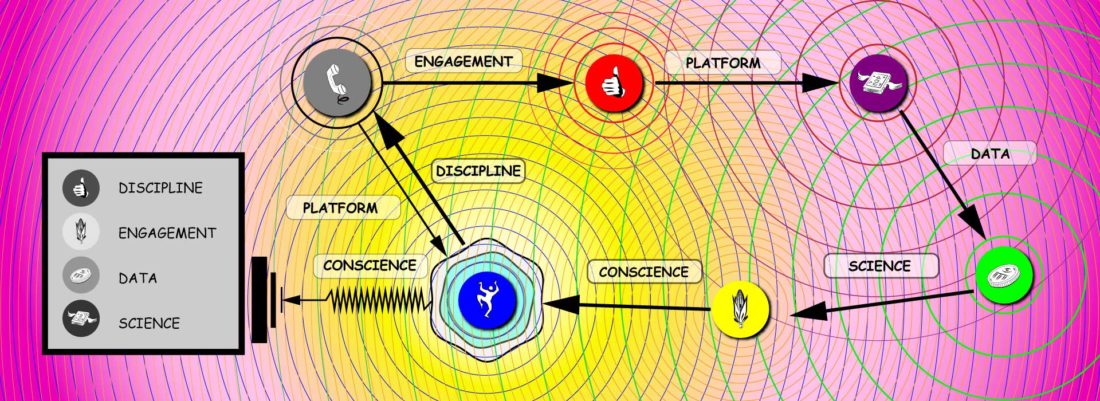

The companies in the CNBC IQ 100 Index are weighted according to each one’s ability to invest in, develop, control and deploy intellectual property to achieve strategic advantage over competitors. Companies with the highest weighting maintain this type of advantage across multiple industries.

The whole, according to MCAM, is indeed greater than the sum of its parts: “DowDuPont combines two excellent portfolios on agricultural science and advanced materials into a potent business model. The new entity is planning the optimization of the agricultural products, materials science and specialty components technologies into separate firms in 18 months, all of which will have scale and technology advantages in their sectors.” Indeed, shares of the DowDuPont have gained more than 5 percent since completing the merger early last month.

With the reweighting, Boeing also continues its steady climb, up from third to second place. MCAM believes Boeing remains best positioned to capitalize on the government’s proposed increases in defense spending: “Boeing has had a blowout year, and the beat goes on. Both its civilian and military aircraft and aerospace businesses are continuing their momentum, and its defense segment is very strong, all built on advanced Boeing technologies.”

With more emphasis on financial and health-care sectors, Xerox has moved to third place. After slipping last quarter, chipmaker Micron Technology holds firm in fourth place. Rounding out the top 5, HP has benefited from its first rise in PC sales in years. So-called “old HP” has also been making strides in modernizing and updating its operating systems, observes MCAM.

Further down the list but still within the top 10, Baxter is the newest company to join the IQ 100. It fills the vacancy created by the DowDuPont merger. MCAM cites the market dynamics of an aging U.S. population and the company’s deployment of “intelligent” medical devices, which are poised for accelerated growth.

The CNBC IQ 100 Index is reweighted quarterly, and components are rebalanced annually.

Eastman Chemical topping IQ100 leaders

Eastman Chemical topping IQ100 leaders

CNBC IQ100 index-beating the brother market over one year up 22%. Today’s leaders include Eastman Chemical, Whirlpool, Exxon Mobil and Broadcom.

General Motors among IQ100 leaders

General Motors among IQ100 leaders

The CNBC iq100 index, leading the broader market over one year up 22 percent. Today’s leaders include Nabors industries, Allergan, General Motors, Level 3 Communications and Garmin.

AMD leading IQ100 top gainers

AMD leading IQ100 top gainers

The CNBC IQ100 index, beating the broader market over one year up 24 percent. Among today’s top gainers AMD, Allergan, Micron, Applied Materials and Nabors Industries.

Top gainers include Target, IQ100 up over 24%

Top gainers include Target, IQ100 up over 24%

The CNBC IQ100 index beating the broader market over one year, up 24 percent. Among today’s top gainers Nabors Industries, Target, Unitedhealth and Baker Hughes.

Teva Pharma showing strong gains, IQ100 up 22%

Teva Pharma showing strong gains, IQ100 up 22%

The CNBC IQ100 index beating the broader market over one year up 22%. Among today’s top gainers Teva Pharma, DowDupont, Micron, International Paper and Pfizer.

Danaher leading the IQ100 top gainers

Danaher leading the IQ100 top gainers

The CNBC iq100 index beating the broader market over one year up 18%. Today’s top gainers Danaher, Citigroup, Sony, General Mills and Bank of America

Technology leading the IQ 100

Technology leading the IQ 100

The CNBC IQ 100 index beating the broader market over one year, up 22%. Today’s leaders include Seagate Technology, Align Technology and Amazon.

Nabors Industries leading top gainers in IQ100

Nabors Industries leading top gainers in IQ100

The CNBC iq100 index beating the broader market over one year up seventeen percent. Among today’s top gainers Target, Baker Hughes, Nabors Industries, Exxon Mobil and Medlife.

Schlumberger continues decline

Schlumberger continues decline

The CNBC IQ100 beating the broader market over one year, up 17 percent. Some of today’s leaders include Western Digital, Prudential Financial, Target and Edwards Lifesciences. On the downside Schlumberger trading at lows not seen since January 2016. For more on the index go to CNBC.com/iq100

Mattel trading at 2009 lows

Mattel trading at 2009 lows

The CNBC IQ100 beating the broader market over one year, up more than sixteen percent. Some of today’s leaders include Western Digital, Garmin, Textron and General Motors, but Mattel on the downside trading at lows not seen since July 2009.

Baker Hughes equals 2009 low

Baker Hughes equals 2009 low

The CNBC iq100 index it tracks big cap companies that get most of their revenue from their own intellectual property. Some of today’s leaders include Western Digital, DXC Technology, Bank of America and Broadcom. On the down side, Baker Hughes hitting a low not seen since April 2009.