Q2 2024 Index Performance Update

The new weights of The U.S. and Global Innovation Indexes will take effect on April 1, 2024.

The new weights of The U.S. and Global Innovation Indexes will take effect on April 1, 2024.

Although the U.S. economy continues to face downturn pressure due to increased interest rate, inflation, and the restart of student loan payments, consumer spending has increased by 5.8% in August compared to last year, according to the Commerce Department. As consumers tend to prioritize short-term needs over long-term goals under the current high-interest rate environment, the Innovation U.S. and Global Indexes increased weights in consumer-based industries including Consumer Durables and Information, Retail, and Finance. Innovative companies held by the indexes are anticipated to generate outperformance in the long run due to their unique advantages over their peers.

With the calm down of the U.S. mainstream inflation, consumer confidence and consumption has been boosted and companies with innovative assets have been outperforming relative to the market. Moving into the 3rd quarter of 2023, the innovation United States index has witnessed significant weight increases in the Consumer Non-Durables, Distribution Services, and Industrial Services sectors, while the Global and Trade War indexes start to overweight innovative companies in the Health Technology, Consumer Services, and Technology Services sectors.

In spite of the recent turmoil in the U.S. banking system, the innovation global and trade war index has still witnessed outperformance to their benchmarks. Moving into the second quarter of 2023, the indexes weights have tilted into the electronic technology, industrial services, and consumer durables sector, where innovation and technological advances have played significant roles in separating winners and losers in the same competing cohorts.

The innovation indexes have witnessed significant outperformance compared to their benchmarks as of YtD 2022, with the innovation α® US index outperforming the Russell 1000 index by 4.67% and the Innovation α® Global index outperforming the MSCI ACWI Index by 1.53%. More details on the index weights and constituents changes are demonstrated in the following link.

Click here to download the full report (including statistics) as a PDF

| 2022Q1 Return (12/29/2021 – 3/28/2022) | 2022Q2 Return (3/28/2022 – 6/27/2022) | 2022Q3 Return (6/27/2022 – 9/27/2022) | 2022Q4 Return (9/27/2022 – 12/27/2022) | Year-to-Date Return (1/3/2022 – 12/27/2022) | Last Year Return (12/29/2021 – 12/27/2022) | |

| Innovation α® US Index | -3.86% | -13.31% | -10.48% | 12.07% | -16.55% | -16.39% |

| Russell 1000 Index | -5.07% | -15.12% | -6.55% | 4.83% | -21.10% | -21.06% |

| Innovation α® Global Index | -4.56% | -13.57% | -12.36% | 12.80% | -18.63% | -18.45% |

| MGIE Trade War Index | -4.14% | -13.66% | -11.59% | 11.72% | -18.46% | -18.25% |

| MSCI ACWI Index | -5.85% | -13.70% | -8.93% | 8.13% | -20.04% | -19.98% |

The Innovation United States Index has witnessed significant outperformance since the beginning of the last quarter of 2022. The outperformance mainly concentrates on the airline and energy industry, including flagship companies such as BA-US and BKR-US.

| Index | Return (09/30/2022 – 11/11/2022) |

| INAU | 11.35% |

| S&P 500 | 16.99% |

| FactSet Symbol | Q4 2022 Index Weight | Return (09/30/2022 – 11/11/2022) |

| JNJ-US | 3.40% | 3.61% |

| AAPL-US | 3.06% | 8.32% |

| MSFT-US | 2.38% | 6.10% |

| QCOM-US | 2.38% | 7.48% |

| BA-US | 2.04% | 46.59% |

| BKR-US | 2.04% | 48.00% |

| IBM-US | 2.04% | 20.50% |

| LMT-US | 2.04% | 20.08% |

| AMZN-US | 1.70% | -10.81% |

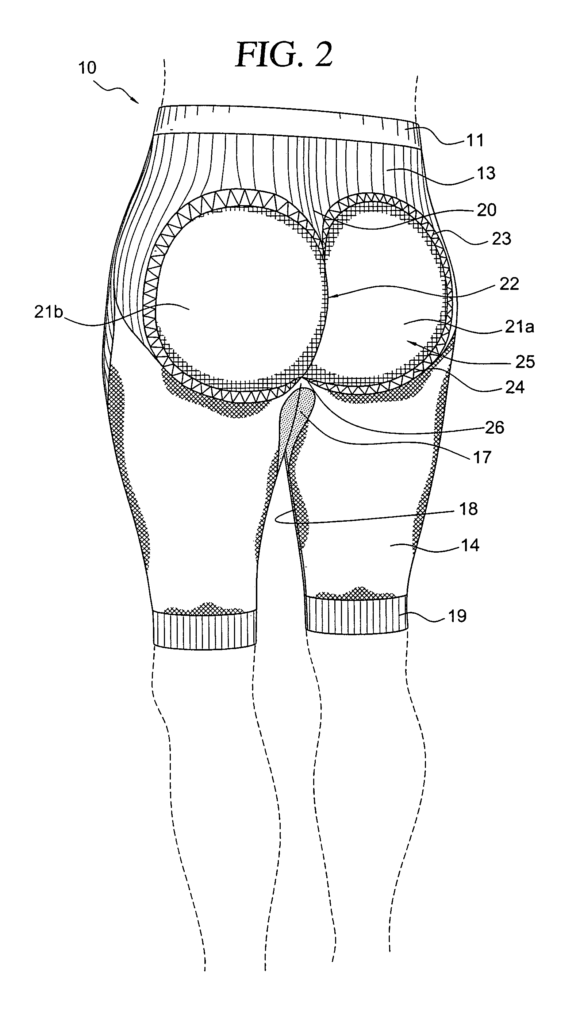

Several Australian news outlets have recently reported a story interviewing Carolyn Taylor, who alleges that Lorna Jane has infringed on her patent for compression tights filed in 2009. Is this a classic underdog story, where the little guy has been exploited and swept under the carpet by their bigger competitor, or is there more to it? With litigation proceedings set to commence on the 3rd of May, we take a closer look. How far has innovation really wandered from the corsets used in the brothels of Europe?

” For those new to the patent world, here is some background to the frivolous patent litigation scene: After a famous case involving the University of California and Microsoft, the long dormant eggs containing troll embryos hatched. When trolls feed, they observe goat passages across heavily trafficked bridges, and install toll booths with the cunning aid of men (and precious few women) in wigs and robes. By making the cost of litigation a burden on genuine businesses, these parasites can suck blood from active businesses and unsuspecting consumers. With the cost of litigation in both time and money extremely high, it is not uncommon for patent opportunists to select a single target with whom litigation or settlement is considered likely to build a war chest for going after much larger targets.”

Patent review can be quite cheeky at times. Diagram from US 7260961. Stylistic throwback to the European brothels of yore

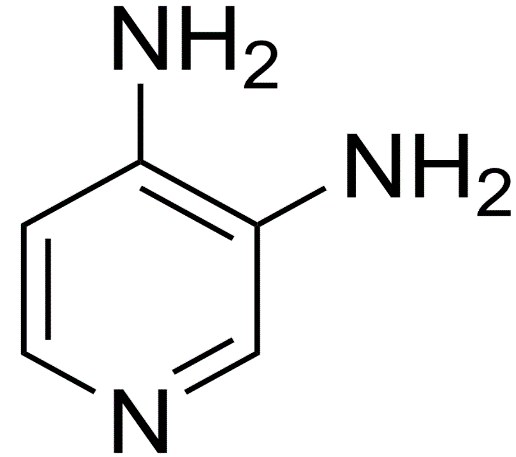

Image courtesy: Edgar181 [Public domain], from Wikimedia Commons

Senator Bernie Sanders wrote an open letter to Catalyst Pharmaceuticals on the 4th of February regarding their newly FDA approved drug to treat Lambert-Eaton Myasthenic Syndrome, saying “Catalyst’s decision to set the annual list price at $375,000 is not only a blatant fleecing of American taxpayers, but is also an immoral exploitation of patients who need this medication.”

Seeing this, M·CAM decided to investigate. What follows is a report on a company that has leveraged the patent system and orphan drug act against their intended use to profit on the suffering of vulnerable patients.

Download the Patently Obvious® report here

Miosotis Jade | (CC BY-SA 4.0)

With the high volume of press coverage and the possibility of liquidation looming for Sears this week, we have decided to publish a Patently Obvious® report on their IP portfolio.

Read/download the full report here

from CNBC.

IQ 100 leaders include GE, Callaway Golf and Apple. The laggards include Teva Pharma, DowDupont and Halliburton.

IQ 100 leaders include Bausch Health, Micron and Broadcom. The laggards; TE Connectivity, Altaba and CBS Corp

IQ 100 leaders include Teva Pharma, Deere and Halliburton. The laggards include Cree Inc., Amazon and Altaba.

The week before last M·CAM had a wonderful visit from Kim Martin. She presented to us a painting in progress which evolved to the finished and beautiful image presented here. When I look at this image I can not help but think of some of the ideas that are threaded through the underlying process that is applied in our algorithms and in the title of this post is a hint to the ideas that I’m eluding too or 2.

M·CAM International, LLC called this one years ago! The investments that Amazon made in building market leading innovation in fulfillment, logistics, data management services, finance and robotics are just a few of the contributing factors to this success!

CNBC video link Here (Amazon leads the IQ 100 after crossing $1 trillion)

1:48 PM ET Tue, 4 Sept 2018

IQ 100 leaders include Teva Pharma, Deere and Halliburton. The laggards include Cree Inc., Amazon and Altaba.

M·CAM has had many changes this summer… and the most recent one I express here with M·CAM’s welcoming into our community our newest member, Qianfan Wu! He is here to help as our newest quantitative analyst in our distillation for excellence!

Manly P. Hall states that “Ramon Llully who was one the great early alchemists, once point out that the great tragedy of the concept of alchemy was the transmutation of metals.” This misconception continues to reverberate in the current collective conscious in the modern era. Alchemy one of the protoscientific tradition practiced in the history of Europe, Asia and Africa inspired the curiosity of notable figures such as Isaac Newton and Carl Jung. And… in Leonardo Da Vinci’s illustration of “The Vitruvian Man” one can extrapolate the alchemical symbol depicted above of “The Squared Circle”, also known as the philosopher’s stone. The illustration above is an interpretation of this very symbol and the inspiration for it is this period at the end of this summer as we move into the months of fall. This is that it may reminds us of the golden thread that held true in alchemy holds true in today chemistry. This is that it has always been the study of change that demands a notion of purity some where held in the concept of rationalizing the irrational with conviction.

Dexcom leads the IQ 100 from CNBC.

August 17th IQ 100 from CNBC.